5 Crucial Money Lessons I’ve Had To Learn The Hard Way

For something we use every day, we know very little about money.

Photo by Andre Sebastian on Unsplash

Society teaches us to be working poor.

Our education system keeps us in the dark when it comes to money. When’s the last time you’ve heard someone say they learned good financial literacy skills in school? Never.

In maths class, I learned how to use a stem and leaf plot. I’ve never once used it again. I remember asking my teacher the purpose of learning this. I was slapped with afterschool detention.

How’s that for cultivating critical thinking?

Our employment system is no better. Our jobs are designed to keep people poor. Here’s a raise. Here’s a new product to spend that raise on. Here’s another raise. Here’s another stupid product. Rinse and repeat until you die.

Nassim Nicholas Taleb famously remarked:

“the three most harmful addictions are heroin, carbohydrates, and a monthly salary.”

The hedonic treadmill of a consumer society leads people to inflate their lifestyle with each raise they get. Keeping them in a cycle of working poverty. Only 40% of Americans don’t have investable assets. The rest spend on non-investable assets.

The biggest culprit in all of this? The financial system.

The gods of finance make their buck on your misunderstanding and ignorance. Their job is to help you navigate an unnecessarily complex system for a tidy fee. Their business model is based on you staying stupid.

They don’t even have to act in your best interest. How crazy is that? Unlike your doctor or lawyer, they don’t have a fiduciary responsibility to you.

This means they can sell you products they make more commission on but is not beneficial for you. And charge you another handsome fee for f*cking you over. Pardon my french.

The deck is stacked against the average person trying to ahead.

But there is hope.

Thanks to the internet, you’ve got access to the world’s knowledge at your fingertips. Most of the financial literacy skills I learned have been through YouTube, Medium, and good books.

I am not saying you should take financial advice from random people on the internet. But you can access some of the best minds in the world for free whenever you want.

Financial knowledge is abundant. It is the desire to learn that is scarce.

I overestimate how much how our education, employment, and finance system are designed to help us. I underestimate my own abilities to teach myself. Besides removing your own gall bladder, most stuff in life is ‘figureoutable’.

#1 Playing The Lottery Keeps You Poor.

“Lotteries are a tax on stupid people who can’t do math”

— Naval Ravikant.

Creating long-term wealth should be a certainty, not a lottery. If you are relying on the off-chance of something spiking, you are gambling, not creating wealth.

The vast majority who have gone into crypto or NFTs are gambling with their money. You hear about the new spike in this stock or that crypto or this NFT. People flock to altcoins for the odd chance Elon Musk will tweet about it.

You might get lucky once or twice. Even a stopped clock is right twice a day. But getting a good result from a bad decision-making process is still a bad decision.

Your mind is what keeps you poor. One day your judgment will falter and your luck will run out. This is why 70% of people who actually do win lotteries end up spending all the money and filing for bankruptcy a few years later.

Real wealth is created in your mind first. You won’t get rich by constantly trying to play the lottery. Most of Warren Buffett’s wealth was created through a combination of good decision-making, consistency and compound interest.

Despite what we are taught, being wealthy is predictable.

If you’re making smart money decisions now based on where you want to be, you’ll be wealthy.

The equation is quite simple:

Strive to increase and diversify your income.

Fix or lower your cost of living.

Consistently invest the difference in low-cost index funds.

Repeat.

Money lesson: Real wealth is built slowly, and then quickly.

#2 Most People Have No Idea What They Are Talking About, Even The Experts.

You would think the financial world is constantly crashing if you regularly watch the news. Bad news sells. Impending doom generates clicks.

The old adage: ‘if it bleeds, it leads’ applies to the financial news as well.

As humans, we are wired to be more sensitive about losing money than gaining money.

Most of the daily cycles of the economy can be ignored. Don’t get caught up in the hype and hysteria the media is designed to drum up. Most financial experts don’t understand the market, let alone predict it.

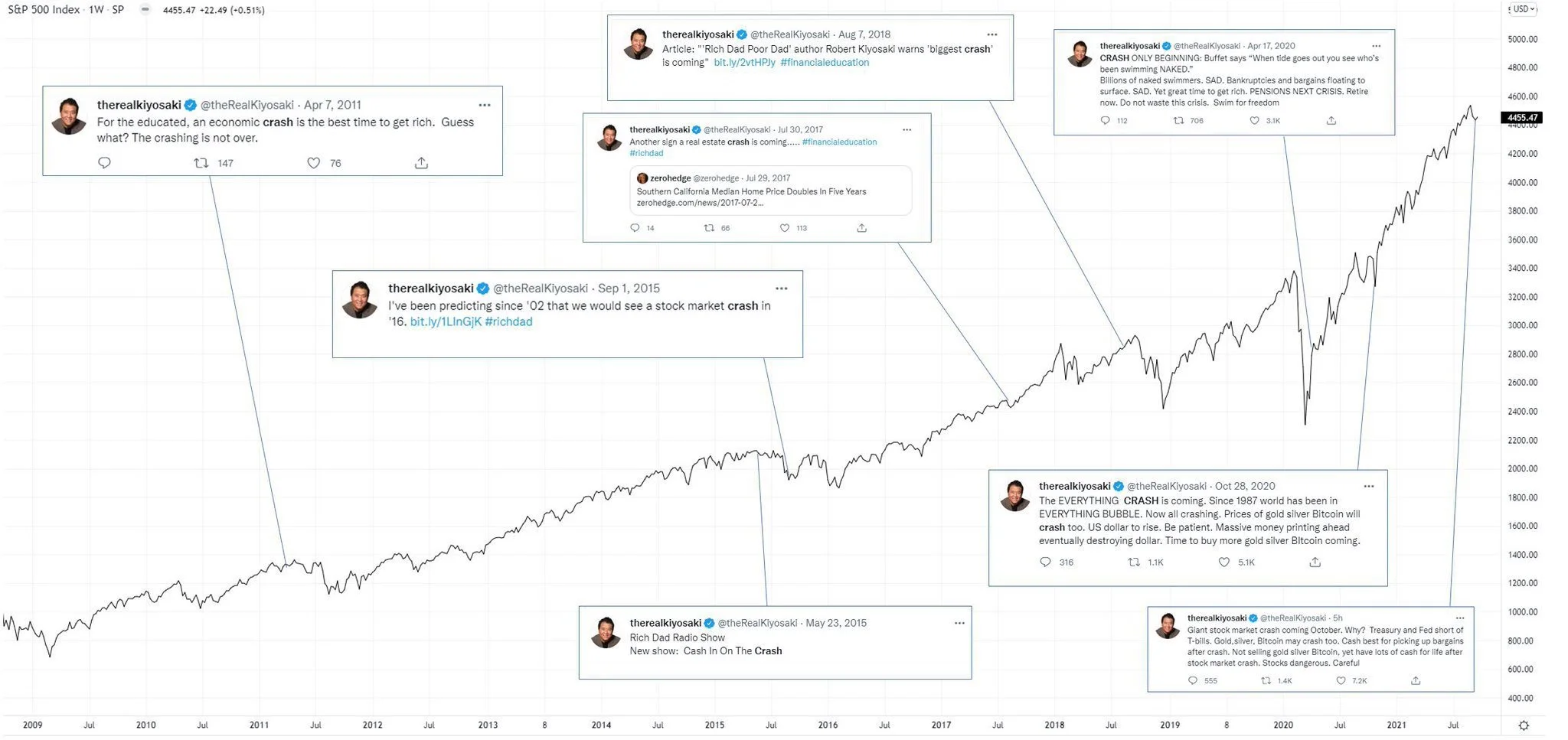

I love Robert Kiyosaki, I’ve read most of his books and quoted him throughout this article. But I am aware of how his business model works and how he makes money peddling hysteria.

For example:

Image Credit: Dr Parik Patel via Twitter

Money lesson: Ignore almost all news. Stick with your investment strategy for the long term.

#3 You Won’t Get Rich Renting Out Your Time.

“Job is an acronym for ‘Just Over Broke.’ ” — Robert Kiyosaki

Trading your time for money won’t allow you to build long-term wealth. Even if you are a doctor or lawyer making relatively large sums of money per hour.

The main reason? Inflation. But not just the economic type.

Lifestyle inflation is the constant desire to upgrade your lifestyle with your income. Each new promotion comes with a new car and a bigger house. Your income level increases but so does your cost of living.

If you don’t break this cycle, you’ll be working poorly for the rest of your life.

What’s the solution? You need to invest your money in appreciating assets, and building equity in a business, or side hustle. The returns on these ventures are exponential over time where your income is only linear.

“If you don’t find a way to make money while you sleep, you will work until you die.” — Warren Buffett.

Money lesson: Invest your money into appreciating assets and build multiple sources of scalable income.

#4 Most Wealth is Invisible.

When I was younger, I would envy people living in big houses, driving fancy cars, and wearing designer watches. I wanted that too when I grew up.

I would watch in awe as I saw sports cars roll by me in the streets and dream of getting rich enough to get a new whip of my own. My delusions were only reinforced by the images we see on social media and in the media.

I’ve done my best to reprogramme myself. Despite making a six-figure salary, I still drive a $3,000 car and actively look to reduce my living costs.

I learned that wealth is not a big house or a fancy car. Most people who have these things are poor, in debt, and probably insecure. Don’t get caught in the game of comparison.

The people who have real wealth put their money in assets that appreciate over time. “The poor and the middle-class work for money. The rich have money to work for them, ”writes Robert Kiyosaki

Money lesson: Wealth is what you don’t see.

#5 Wealth Allows You To Buy Back Time.

My desire for wealth is to have complete freedom over my time. By 35, I don’t want to have to report to a boss or a clock. I want to be able to do whatever I want, whenever I want.

This doesn’t mean sailing on yachts sipping wine either. That would get really stupid really fast. Time freedom is the ability to take long weekends whenever I want or travel to different places and working the hours I want.

The plan isn’t to retire. It’s to retire from working for other people — Finance Hipster

Time is your most precious asset. It is the only thing you can’t get back.

Building wealth only to have more obligations and responsibilities seems pointless to me. If I have $100 million in the bank but I am still having to work 100+ hour weeks, I would rather have less money and more freedom.

What most people don’t realize is how little money they need to actually save to have more freedom. My lean financial freedom number is $750,000 invested.

Given my current net worth and income, I can reach that number in 10 years. At this point, work starts to become optional and I can transition to working for myself.

Money lesson: The point of building wealth is to create freedom over your time.

___________________________________________

If you enjoyed this article, you can connect with me HERE.

You can also support more of my work by becoming a Medium Member using my referral link: michael-lim.medium.com